You do not live a static life. Your career moves, your family evolves, your map keeps expanding. What you need is not an insurance card that expires at the border—but a health strategy that travels with you, adapts to your seasons of life, and protects your peace of mind as confidently in Singapore as it does in Spain. This is what borderless coverage means: continuity, clarity, and care that keeps pace with your ambitions.

What “Without Borders” Really Means

In today’s global reality, crossing time zones should not mean navigating a new policy from scratch. It should mean continuity of benefits, predictable claims, and a human team that guides you when the stakes are high and the rules are different. The right plan does not just reimburse—it reduces friction, so you can focus on work, family, and the joy of discovering a new city.

When you are ready to move beyond patchwork solutions, start with an expert partner who lives and breathes expat healthcare. The Expatmedicare insurance provider brings together regional knowledge, plan design expertise, and concierge-level guidance to help you compare, choose, and manage cover that actually fits your life—today and in two moves’ time.

Borderless insurance is not a buzzword; it is a set of design choices. The fundamentals are simple:

- worldwide inpatient protection as your backbone,

- an outpatient pathway that works in your country of residence (and still responds when you travel),

- and evacuation/repatriation that is fast, medically appropriate, and fully coordinated.

The result is continuity—across visas, employers, and geographies.

Just as importantly, borderless cover addresses the blind spots of “basic” plans. It clarifies direct billing versus reimbursement, ring-fences major risks (cancer, chronic conditions, maternity), and eliminates nasty surprises such as network gaps, slow claims, or waiting periods that re-start when you relocate.

Benefit Design: The Essentials That Travel With You

The right plan should be easy to understand, easier to use, and robust where it counts. Look for:

- A global inpatient core with high overall limits and clear cancer coverage.

- Outpatient options you can tune (GP-first pathways, specialist access, diagnostics, prescription budgets).

- Emergency medical evacuation and repatriation, coordinated end-to-end.

- Maternity benefits aligned to your horizon (and the countries you may use).

- Mental health support, telemedicine, and second-opinion access baked in.

- Transparent cost-sharing (deductibles/co-pays) to optimise premiums without compromising protection.

- Digital claims, direct billing networks, and multilingual assistance.

By the time you compare across regions and life stages, you will notice a pattern: the plans that age well are the ones built for portability, not just price.

If you want a curated shortlist of global options that meet these criteria, explore international medical insurance pathways that Expatmedicare can configure to your needs and destinations.

How to Balance Premiums, Portability, and Peace of Mind

Price matters. But a low sticker price with hidden gaps is the most expensive mistake an expat can make. Treat plan design as a set of levers, not a fixed box:

- Use deductibles and co-pays strategically. Raise them on routine outpatient—never on big-ticket inpatient or oncology.

- Bundle what you will actually use. If your employer already covers travel mishaps, invest instead in stronger outpatient and mental health.

- Think in horizons, not months. If a relocation is likely within 12–18 months, prioritise plans with broad networks and portable underwriting.

- Document pre-existing conditions properly. A good broker will push for clear, written underwriting outcomes to avoid ambiguity later.

- Consolidate your family on one policy when possible. One claims pathway, one renewal cycle, less admin.

The Fine Print That Makes a Big Difference

Even world-class plans can disappoint if you overlook the details. Before you sign, pressure-test these areas:

- Networks and direct billing. Are your preferred hospitals and clinics actually cashless, or will you be reimbursing?

- Chronic and long-term care. Is follow-up therapy covered or capped? Are biologics included under oncology?

- Maternity specifics. Waiting periods, neonatal limits, and NICU coverage vary dramatically.

- Geographical areas. “Worldwide excluding US” can be smart—until your project lands you in the US twice a quarter.

- Evacuation triggers. Who decides, how fast, to where, and who pays for the return?

- Renewal guarantees. Are benefits guaranteed renewable regardless of claims history or will terms change at the worst moment?

Choosing With Confidence: A Simple Decision Framework

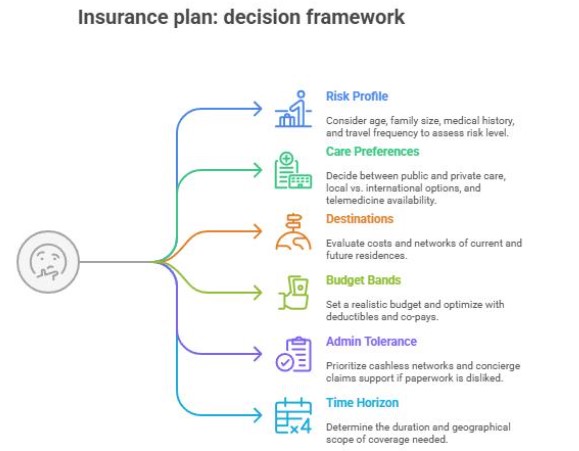

When you strip away the jargon, great expat insurance decisions follow a clear logic. Use this checklist to compare options apples-to-apples:

- Your risk profile. Age, family size, medical history, travel frequency.

- Your care preferences. Public vs. private, local clinics vs. international hospitals, telemedicine availability.

- Your destinations. Current residence plus likely next stops—costs and networks differ widely.

- Your budget bands. Set a realistic range, then optimise within it using deductibles and co-pays.

- Your admin tolerance. If you hate paperwork, prioritise cashless networks and concierge claims support.

- Your time horizon. One year in one country, or several years across three?

Why Work With a Specialist (Not Just a Search Bar)

Expat insurance is a niche. The rules change by market, the wording is dense, and the stakes are high. A specialist broker does three things you cannot easily do alone:

- Translate your lifestyle into benefits. They turn “I travel to three countries, expect a baby next year, and want mental health support” into a structured plan.

- Negotiate and escalate. From underwriting terms to claims exceptions, they know which doors to knock on and how to get answers.

Stay with you as you move. A move to a new country is when most problems happen. Having the same team on your side eliminates re-learning and delays.